- Buy litecoin mining hardware

- Crypto com support

- Btc live price

- Apps cryptocurrency

- Cryptocurrency bitcoin price

- Bitcoin halving price chart

- Buy bitcoin online

- Crypto credit card

- Buy bitcoin cash app

- Dogecoin volume

- Spell price crypto

- Ethusd price

- How to withdraw money from cryptocom

- Cryptocurrency to buy

- Cryptocom card

- Crypto merchant

- Bitgert crypto price

- Cryptocom trading fees

- Titan token crypto

- New crypto to buy

- Cryptocom login

- Cryptocom sell to fiat wallet

- Bitcoin apps

- Where to buy ethereum max

- Buy bonfire crypto

- Dogecoin sellers

- Bitcoin cryptocurrency

- Cryptocurrency prices

- How does bit coin work

- How to transfer money from cryptocom to bank account

- Million worth bitcoins

- Defi ethereum wall

- Cryptocurrency app

- Best crypto to buy

- Buy bitcoin with credit card instantly

- Will crypto bounce back

- What is ethereum trading at

- Crypto wallet app

- Google bitcoin

- Cryptocom dogecoin

- Crypto to usd

- Crypto market live

- Crypto status

- Where to buy crypto

- Is crypto down

- New crypto coins

- Cheapest crypto on crypto com

- How much to buy dogecoin

- Crypto pay

- How much is pi crypto worth

- Dogecoin exchange

- Dogecoin converter

- Bit coin price in us

- How much is bitcoin

- Where to buy ethereum

- Paypal btc wallet

- Free ethereum

- Crypto exchange

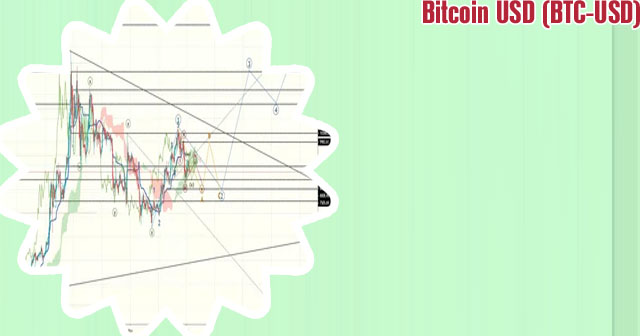

Btc usd chart

When it comes to analyzing the BTC USD chart, it is essential to stay informed about the latest trends and developments in the cryptocurrency market. These three articles will provide valuable insights and information to help you make informed decisions when it comes to trading Bitcoin against the US dollar.

Bitcoin traders around the world eagerly anticipate the weekly close of the cryptocurrency, as it often signals potential trends and price movements for the upcoming week. To help traders stay informed and make informed decisions, here are three articles that provide valuable insights into the Bitcoin weekly close:

Analyzing Bitcoin Price Movements Post-Weekly Close: What to Expect

Bitcoin's price movements post-weekly close are always closely watched by investors and traders alike, as they can provide valuable insights into the market's direction in the coming days. As we approach the end of another trading week, it is important to analyze recent trends and indicators to better understand what to expect in the near future.

One key factor to consider is the level of market sentiment towards Bitcoin. Positive news and developments in the industry can lead to increased buying interest, pushing prices higher. On the other hand, negative news or regulatory concerns can lead to a sell-off and downward pressure on prices. Keeping a close eye on the latest headlines and market sentiment can help investors make more informed decisions.

Technical analysis is another important tool for predicting Bitcoin's price movements. By studying chart patterns, support and resistance levels, and key indicators such as moving averages and RSI, traders can identify potential entry and exit points with greater accuracy. It is worth noting that technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

In conclusion, staying informed about market sentiment and utilizing technical analysis can help investors anticipate Bitcoin price movements post-weekly close more effectively. By combining these two approaches, traders can better navigate the volatile cryptocurrency market and make more informed decisions.

Strategies for Trading Bitcoin Based on Weekly Close Data

In the fast-paced world of cryptocurrency trading, having a solid strategy is essential for success. One approach that has gained popularity is analyzing Bitcoin based on weekly close data. By focusing on the weekly closing prices of Bitcoin, traders can gain valuable insights into market trends and make more informed trading decisions.

One key strategy that traders can use is trend following, which involves identifying the direction of the trend based on weekly close data and trading in the same direction. This approach can help traders capitalize on long-term price movements and minimize the impact of short-term fluctuations.

Another strategy is mean reversion, which involves identifying when the price of Bitcoin deviates significantly from its average based on weekly close data and taking advantage of potential price corrections. This approach can be particularly useful for traders looking to profit from short-term price movements.

Overall, analyzing Bitcoin based on weekly close data can provide traders with a valuable tool for making informed decisions in the volatile cryptocurrency market. By incorporating these strategies into their trading approach, traders can increase their chances of success and navigate the ups and downs of Bitcoin trading more effectively.

This article is important for traders looking to enhance their trading strategies in the world of cryptocurrency, specifically focusing on Bitcoin. By understanding how to analyze weekly close data and implement trend following and mean reversion strategies, traders

The Impact of Market Sentiment on Bitcoin's Weekly Close Performance

Bitcoin's weekly close performance is heavily influenced by market sentiment, which plays a crucial role in determining the direction of the cryptocurrency's price movements. Market sentiment refers to the overall attitude of investors towards a particular asset, reflecting their optimism or pessimism about its future prospects.

-

Price Volatility: Market sentiment can lead to increased price volatility in Bitcoin's weekly close performance, as investors react to positive or negative news and events impacting the market.

-

Investor Behavior: The behavior of investors, driven by market sentiment, can result in rapid fluctuations in Bitcoin's price, with sudden surges or drops in value based on prevailing attitudes towards the cryptocurrency.

-

Market Manipulation: Market sentiment can also be manipulated by certain actors in the market, who may spread rumors or engage in coordinated trading activities to influence investor sentiment and drive the price of Bitcoin in a particular direction.

-

Regulatory Developments: Changes in regulatory frameworks governing cryptocurrencies can also impact market sentiment towards Bitcoin, with new regulations or enforcement actions affecting investor confidence and leading to price fluctuations.

-

Media Coverage: Media coverage of Bitcoin and related developments can shape market sentiment, with positive or negative news stories influencing investor perceptions and driving trading activity in the market.