- Buy litecoin mining hardware

- Crypto com support

- Btc live price

- Apps cryptocurrency

- Cryptocurrency bitcoin price

- Bitcoin halving price chart

- Buy bitcoin online

- Crypto credit card

- Buy bitcoin cash app

- Dogecoin volume

- Spell price crypto

- Ethusd price

- How to withdraw money from cryptocom

- Cryptocurrency to buy

- Cryptocom card

- Crypto merchant

- Bitgert crypto price

- Cryptocom trading fees

- Titan token crypto

- New crypto to buy

- Cryptocom login

- Cryptocom sell to fiat wallet

- Bitcoin apps

- Where to buy ethereum max

- Buy bonfire crypto

- Dogecoin sellers

- Bitcoin cryptocurrency

- Cryptocurrency prices

- How does bit coin work

- How to transfer money from cryptocom to bank account

- Million worth bitcoins

- Defi ethereum wall

- Cryptocurrency app

- Best crypto to buy

- Buy bitcoin with credit card instantly

- Will crypto bounce back

- What is ethereum trading at

- Crypto wallet app

- Google bitcoin

- Cryptocom dogecoin

- Crypto to usd

- Crypto market live

- Crypto status

- Where to buy crypto

- Is crypto down

- New crypto coins

- Cheapest crypto on crypto com

- How much to buy dogecoin

- Crypto pay

- How much is pi crypto worth

- Dogecoin exchange

- Dogecoin converter

- Bit coin price in us

- How much is bitcoin

- Where to buy ethereum

- Paypal btc wallet

- Free ethereum

- Crypto exchange

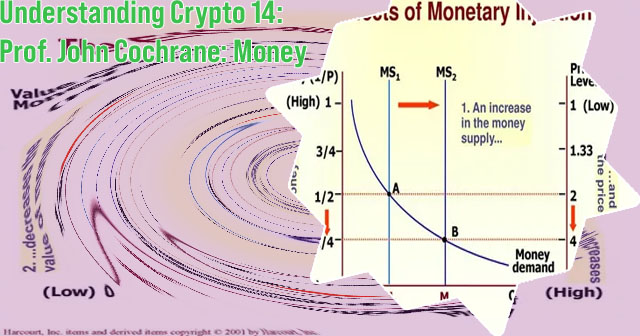

Bitcoin misguided fear money creation

Bitcoin has often been the subject of misguided fear regarding its impact on money creation. Many people believe that Bitcoin is a threat to traditional currency and could lead to economic instability. However, there are articles that can help dispel these misconceptions and provide a better understanding of how Bitcoin works and its implications for money creation. Below are four articles that delve into this topic and offer valuable insights into the relationship between Bitcoin and money creation.

Many people have expressed concerns about Bitcoin inflation, believing it to be a major flaw in the cryptocurrency. However, these fears are often misguided and based on a lack of understanding of how Bitcoin operates. To help clarify this issue, we have compiled a list of two articles that delve into the topic of Bitcoin inflation and debunk common misconceptions surrounding it.

Debunking the Myth of Bitcoin Inflation: Understanding the Halving Process

Bitcoin halving is a significant event in the cryptocurrency world that occurs approximately every four years. This process involves reducing the rewards miners receive for validating transactions on the blockchain by half. The purpose of this mechanism is to control the supply of Bitcoin and prevent inflation by gradually decreasing the rate at which new coins are generated.

One common misconception about Bitcoin is that it is an inflationary currency due to its decentralized nature and the potential for unlimited mining. However, the halving process ensures that the supply of Bitcoin is limited to 21 million coins, making it a deflationary asset in the long run.

It is essential to understand the implications of Bitcoin halving for investors and enthusiasts alike. Here are some key points to consider:

- Limited Supply: The halving process reduces the rate at which new Bitcoins are created, ultimately leading to a capped supply of 21 million coins.

- Price Volatility: Historically, Bitcoin halving events have been associated with increased price volatility, as supply decreases while demand remains constant or increases.

- Mining Rewards: Miners play a crucial role in securing the Bitcoin network, and halving events can impact their profitability and incentives to continue mining.

Why Bitcoin's Fixed Supply Is Actually a Strength, Not a Weakness

Bitcoin's fixed supply has long been a topic of debate among investors and economists. Many critics argue that the cryptocurrency's fixed supply of 21 million coins is a weakness, as it could limit its ability to adapt to changing market conditions. However, proponents of Bitcoin's fixed supply argue that it is actually a strength, as it ensures that the cryptocurrency will retain its value over time.

One of the main benefits of Bitcoin's fixed supply is its scarcity. Unlike traditional fiat currencies, which can be printed endlessly by central banks, Bitcoin has a finite supply. This scarcity gives Bitcoin its intrinsic value and helps protect it against inflation. In fact, some experts argue that Bitcoin's fixed supply makes it a better store of value than traditional assets like gold.

Additionally, Bitcoin's fixed supply helps to create a predictable monetary policy. With a predetermined issuance schedule, investors can have confidence in the long-term value of Bitcoin. This stability is especially important in today's volatile economic climate, where central banks are printing money at an unprecedented rate.

Overall, Bitcoin's fixed supply is a strength that sets it apart from traditional currencies. By ensuring scarcity and predictability, Bitcoin's fixed supply helps to protect its value and make it a reliable store of wealth. In an era of economic uncertainty, Bitcoin's fixed supply