- Buy litecoin mining hardware

- Crypto com support

- Btc live price

- Apps cryptocurrency

- Cryptocurrency bitcoin price

- Bitcoin halving price chart

- Buy bitcoin online

- Crypto credit card

- Buy bitcoin cash app

- Dogecoin volume

- Spell price crypto

- Ethusd price

- How to withdraw money from cryptocom

- Cryptocurrency to buy

- Cryptocom card

- Crypto merchant

- Bitgert crypto price

- Cryptocom trading fees

- Titan token crypto

- New crypto to buy

- Cryptocom login

- Cryptocom sell to fiat wallet

- Bitcoin apps

- Where to buy ethereum max

- Buy bonfire crypto

- Dogecoin sellers

- Bitcoin cryptocurrency

- Cryptocurrency prices

- How does bit coin work

- How to transfer money from cryptocom to bank account

- Million worth bitcoins

- Defi ethereum wall

- Cryptocurrency app

- Best crypto to buy

- Buy bitcoin with credit card instantly

- Will crypto bounce back

- What is ethereum trading at

- Crypto wallet app

- Google bitcoin

- Cryptocom dogecoin

- Crypto to usd

- Crypto market live

- Crypto status

- Where to buy crypto

- Is crypto down

- New crypto coins

- Cheapest crypto on crypto com

- How much to buy dogecoin

- Crypto pay

- How much is pi crypto worth

- Dogecoin exchange

- Dogecoin converter

- Bit coin price in us

- How much is bitcoin

- Where to buy ethereum

- Paypal btc wallet

- Free ethereum

- Crypto exchange

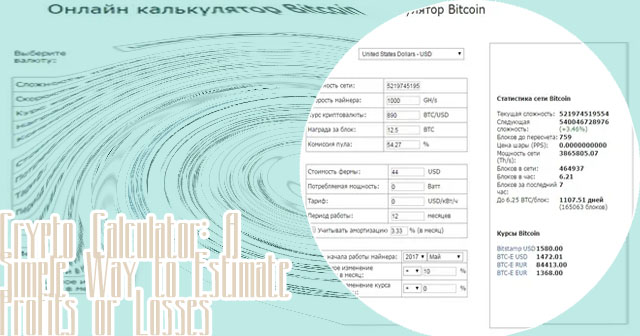

Bitcoin calculator time

Calculating the time it takes to mine a Bitcoin can be a complex process that requires a deep understanding of mining difficulty, hash rate, and electricity costs. To help simplify this process, we have compiled a list of three articles that provide valuable insights and tools for calculating the time it takes to mine a Bitcoin. These articles cover topics such as mining calculators, profitability calculations, and tips for optimizing mining efficiency. Whether you are a beginner looking to get started in Bitcoin mining or an experienced miner seeking to maximize your profits, these articles will provide you with the information you need to make informed decisions and achieve success in the world of cryptocurrency.

As the value of Bitcoin continues to rise, many investors are wondering if it will ever hit

Many people are intrigued by the possibility of Bitcoin reaching $1 million in value and are looking for ways to calculate potential profits. To help solve this topic, here are two articles that provide insights and tools for calculating potential profits if Bitcoin hits $1 million.

million. To help answer this question, we have compiled a list of two articles that provide valuable insights and tools for calculating the potential future value of Bitcoin. These articles offer different perspectives and methodologies for predicting the price of Bitcoin, helping investors make informed decisions about their investment strategies.As the value of Bitcoin continues to rise, many investors are wondering if it will ever hit

As the value of Bitcoin continues to rise, many investors are wondering if it will ever hit million. To help answer this question, we have compiled a list of two articles that provide valuable insights and tools for calculating the potential future value of Bitcoin. These articles offer different perspectives and methodologies for predicting the price of Bitcoin, helping investors make informed decisions about their investment strategies.

million. To help answer this question, we have compiled a list of two articles that provide valuable insights and tools for calculating the potential future value of Bitcoin. These articles offer different perspectives and methodologies for predicting the price of Bitcoin, helping investors make informed decisions about their investment strategies.The Mathematical Formula for Predicting Bitcoin's Future Value

As Bitcoin continues to capture the attention of investors and enthusiasts worldwide, the quest to accurately predict its future value remains a top priority. One approach that has gained traction in recent years is the use of mathematical formulas to forecast the price of this popular cryptocurrency.

These formulas typically rely on historical data, market trends, and various mathematical models to generate predictions about Bitcoin's future value. While no formula can guarantee absolute accuracy due to the volatile nature of the cryptocurrency market, they can provide valuable insights and help investors make more informed decisions.

One practical use case of using a mathematical formula to predict Bitcoin's future value is for day traders looking to capitalize on short-term price movements. By analyzing historical data and applying the formula, traders can identify potential buying and selling opportunities to maximize profits. For example, a trader who used a mathematical formula to predict a price increase in Bitcoin was able to purchase the cryptocurrency at a low price and sell it for a significant profit when the price surged.

In conclusion, while predicting Bitcoin's future value with 100% accuracy may be challenging, the use of mathematical formulas can certainly help investors navigate the volatile cryptocurrency market more effectively. By leveraging data and mathematical models, individuals can make more informed decisions and potentially capitalize on the opportunities presented by Bitcoin's price fluctuations.

Using Historical Data to Forecast Bitcoin's Price Trajectory

Bitcoin's price trajectory has been a topic of great interest and speculation for many investors and analysts in recent years. One method that has gained popularity among experts is the use of historical data to forecast where Bitcoin's price may be headed in the future.

By analyzing past price movements, trends, and patterns, analysts can gain valuable insights into potential future price movements. One key aspect of using historical data is looking at key events that have influenced Bitcoin's price in the past. For example, the infamous Mt. Gox hack in 2014, which resulted in the loss of over 850,000 bitcoins, had a significant impact on the price of Bitcoin at the time.

Additionally, the involvement of famous personalities such as Elon Musk, who has openly expressed his support for Bitcoin, has also played a role in shaping Bitcoin's price trajectory. Musk's tweets and public statements have been known to cause significant fluctuations in the price of Bitcoin and other cryptocurrencies.

Furthermore, the regulatory environment in different regions around the world has also had a notable impact on Bitcoin's price. For instance, the recent crackdown on cryptocurrency mining in China led to a sharp drop in Bitcoin's price as miners were forced to shut down their operations.