- Buy litecoin mining hardware

- Crypto com support

- Btc live price

- Apps cryptocurrency

- Cryptocurrency bitcoin price

- Bitcoin halving price chart

- Buy bitcoin online

- Crypto credit card

- Buy bitcoin cash app

- Dogecoin volume

- Spell price crypto

- Ethusd price

- How to withdraw money from cryptocom

- Cryptocurrency to buy

- Cryptocom card

- Crypto merchant

- Bitgert crypto price

- Cryptocom trading fees

- Titan token crypto

- New crypto to buy

- Cryptocom login

- Cryptocom sell to fiat wallet

- Bitcoin apps

- Where to buy ethereum max

- Buy bonfire crypto

- Dogecoin sellers

- Bitcoin cryptocurrency

- Cryptocurrency prices

- How does bit coin work

- How to transfer money from cryptocom to bank account

- Million worth bitcoins

- Defi ethereum wall

- Cryptocurrency app

- Best crypto to buy

- Buy bitcoin with credit card instantly

- Will crypto bounce back

- What is ethereum trading at

- Crypto wallet app

- Google bitcoin

- Cryptocom dogecoin

- Crypto to usd

- Crypto market live

- Crypto status

- Where to buy crypto

- Is crypto down

- New crypto coins

- Cheapest crypto on crypto com

- How much to buy dogecoin

- Crypto pay

- How much is pi crypto worth

- Dogecoin exchange

- Dogecoin converter

- Bit coin price in us

- How much is bitcoin

- Where to buy ethereum

- Paypal btc wallet

- Free ethereum

- Crypto exchange

Accept crypto payment

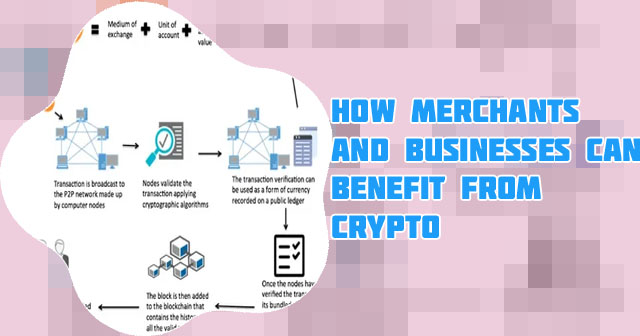

Cryptocurrency is steadily gaining popularity as a form of payment among merchants. However, navigating the world of crypto payments can be daunting for business owners. To help crypto merchants succeed in this digital landscape, we have compiled a list of articles that offer valuable insights and tips on how to effectively integrate cryptocurrency payments into their business operations.

The Benefits of Accepting Cryptocurrency Payments for Merchants

In today's digital age, the world of commerce is constantly evolving, with new technologies and payment methods emerging to meet the demands of modern consumers. One such innovation that has been gaining popularity in recent years is cryptocurrency. For merchants looking to stay ahead of the curve, accepting cryptocurrency payments can offer a range of benefits.

One of the key advantages of accepting cryptocurrency payments is the potential for lower transaction fees compared to traditional payment methods. Cryptocurrency transactions typically have lower processing fees, which can help merchants save money in the long run. Additionally, accepting cryptocurrency can also open up new markets for businesses, as it allows them to cater to a global customer base without the need for currency conversion.

Another benefit of accepting cryptocurrency payments is the increased security it offers. Cryptocurrencies are decentralized and use blockchain technology, making them less vulnerable to fraud and hacking. This can help merchants build trust with their customers and protect sensitive financial information.

Overall, accepting cryptocurrency payments can streamline transactions, reduce costs, and enhance security for merchants. By embracing this innovative payment method, businesses can position themselves as forward-thinking and attract a new wave of tech-savvy customers.

This article is important for merchants who are looking to explore new payment options and stay competitive in an ever-changing marketplace. By understanding the benefits of accepting

How to Safely Accept Crypto Payments: A Guide for Merchants

Cryptocurrency has become increasingly popular in recent years, with more and more merchants accepting digital currencies as a form of payment. However, with this rise in popularity comes the need for merchants to ensure they are accepting crypto payments safely and securely.

Here are some key tips for merchants looking to safely accept crypto payments:

-

Choose a reliable payment processor: When accepting cryptocurrency payments, it is essential to choose a reputable payment processor that offers secure transactions and fraud protection.

-

Use a secure wallet: It is important for merchants to use a secure wallet to store their cryptocurrency payments. Hardware wallets, such as Ledger or Trezor, offer an extra layer of security compared to online wallets.

-

Implement strong security measures: Merchants should implement strong security measures, such as two-factor authentication and encryption, to protect their crypto payments from hackers and cyber attacks.

-

Educate your staff: It is crucial to educate your staff on how to safely accept and process crypto payments. This includes training them on how to identify potential scams and fraudulent transactions.

-

Stay up to date with industry trends: The cryptocurrency landscape is constantly evolving, so it is important for merchants to stay informed about the latest industry trends and best practices for accepting crypto payments.

Top Cryptocurrency Payment Processors for Merchants

Cryptocurrency payment processors are becoming increasingly popular among merchants worldwide due to the benefits they offer in terms of security, cost-effectiveness, and efficiency. These processors allow businesses to accept digital currency payments from customers, opening up new opportunities for growth and expansion in the global marketplace.

One of the top cryptocurrency payment processors for merchants is BitPay, a leading provider that enables businesses to accept Bitcoin and Bitcoin Cash payments seamlessly. BitPay has established itself as a trusted platform with a user-friendly interface and robust security features, making it an ideal choice for merchants looking to enter the world of digital currencies.

Another key player in the cryptocurrency payment processing industry is CoinGate, which supports a wide range of digital currencies beyond just Bitcoin. CoinGate offers merchants the flexibility to accept payments in various cryptocurrencies, including Ethereum, Litecoin, and Ripple, giving them access to a broader customer base.

For merchants seeking a more traditional payment processing experience with added cryptocurrency capabilities, Coinbase Commerce is a popular choice. Coinbase Commerce allows businesses to accept a wide range of digital currencies while seamlessly integrating with existing e-commerce platforms, making it a convenient option for merchants of all sizes.

In conclusion, cryptocurrency payment processors offer merchants a secure, cost-effective, and efficient way to accept digital currency payments from customers. With options like BitPay,

Crypto Accounting 101: Managing Finances for Merchants

In the rapidly evolving world of cryptocurrency, proper accounting practices are essential for merchants looking to effectively manage their finances. "Crypto Accounting 101: Managing Finances for Merchants" provides a comprehensive guide on how to navigate the complexities of accounting in the digital currency realm.

The book covers key topics such as tracking transactions, calculating taxes, and managing cash flow, all tailored specifically for merchants operating in the crypto space. With the growing popularity of cryptocurrencies like Bitcoin and Ethereum, it is crucial for businesses to stay informed about the financial implications of using these digital assets in their operations.

One of the most valuable aspects of the book is its practical approach to accounting, breaking down complex concepts into easily understandable terms. Whether you are a seasoned entrepreneur or new to the world of crypto, this resource offers valuable insights that can help you effectively manage your finances and stay compliant with regulations.

Overall, "Crypto Accounting 101: Managing Finances for Merchants" is an indispensable resource for anyone looking to navigate the financial landscape of cryptocurrency. By providing clear and actionable advice, this book empowers merchants to make informed decisions about their finances and stay ahead in the ever-changing world of digital currency.